Column Definitions

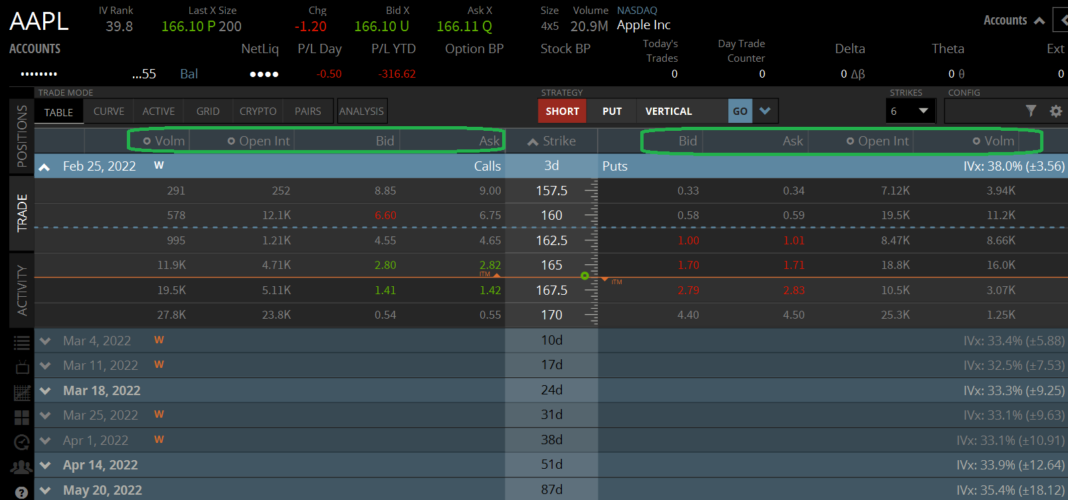

Within the Option Chain, you’ll discover various columns that show crucial info. For instance, trading extent indicates the number of contracts traded during a given time frame. Open interest represents the full quantity of wonderful contracts which have no longer been settled or exercised. It’s a crucial factor to consider, as it could reflect marketplace sentiment and ability rate actions. Lastly, the change in open interest exhibits the difference between the previous and present-day trading periods, highlighting marketplace hobbies.

Call Options

Call alternatives are an exciting part of the NSE Option Chain. They deliver the holder the right, but now not the duty, to shop for an underlying asset at the required strike fee within a particular period. In the Option Chain, call alternatives are displayed alongside their respective strike prices and related facts. Take the word of that info, as it can be instrumental in making knowledgeable trading choices.

Put Options

Put options are the turn side of the coin. They provide the holder with the right, but now not the obligation, to promote an underlying asset at the required strike rate inside a selected timeframe. You’ll find placed alternatives presented inside the Option Chain, along with their corresponding strike fees and further information. Understanding placed options is essential for an extra complete understanding of the Option Chain.

Analyzing the NSE Option Chain

Now that we draw close to the basic components of the NSE Option Chain, it’s time to dive deeper into studying this powerful device. Let’s explore some key elements together:

Identifying Open Interest

Remember that time period we noted in advance – open hobby? Well, it plays an important position within the Option Chain. Open hobby represents the entire range of open contracts, which are first-rate and have no longer been settled or exercised. By retaining an eye fixed on an open hobby, we will advantage of insights into marketplace sentiment and potential rate movements. A higher open hobby typically indicates better activity and indicates tremendous dealer interest.

Spotting High Volumes and Strikes

High buying and selling volumes are another important detail to don’t forget when analyzing the Option Chain. They suggest strong marketplace interest and may have an effect on option expenses. Additionally, strike costs can function as essential indicators for potential guide and resistance levels. By identifying strikes with good-sized trading volumes, we are able to discover capacity areas of marketplace hobby and gauge capacity rate movements.

Gauging Market Sentiment

Changes in buying and selling quantity and open hobbies within the Option Chain can provide precious insights into marketplace sentiment. Identifying growing or lowering tendencies can assist us verify marketplace sentiment and expect capacity rate movements. By incorporating marketplace sentiment analysis, we will make extra informed trading choices.